Lease vs Buy: How Kenyan SMEs Should Decide (Spoiler: It’s Not One-Size-Fits-All)

Lease vs Buy! it’s always a debate you can’t miss in the corporate world.

You’ve stood in front of the price tag before — maybe it’s a truck, a production oven, or a stack of computers. Your head says, owning builds equity, but your cashflow says, don’t tie up the money you need to run the business. We get it. We’ve helped dozens of Kenyan SMEs wrestle with the same decision, and the honest answer is: both options can be right — depending on what you want to achieve.

Below, we walk you through the real pros and cons, show when buying makes sense (and when it doesn’t), explain why leasing can be the smarter, faster option for many SMEs, and tell you how Discount Capital can help if leasing is the way forward.

Quick definitions — so we’re on the same page

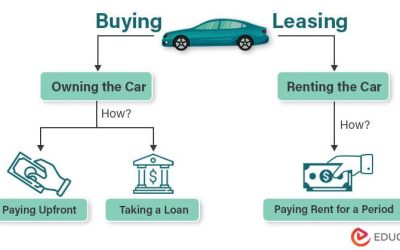

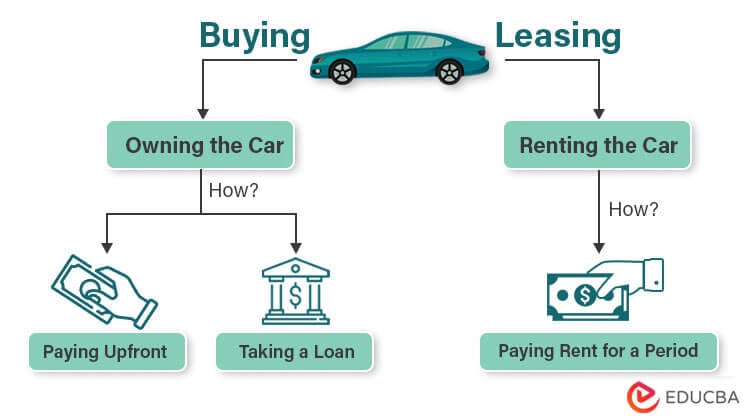

- Buy (Purchase) — you pay for the asset and it becomes yours. You bear maintenance, depreciation, and resale risk, but you also capture any residual value.

- Lease — you pay to use the asset for a set period. At the end of the lease you typically return it, buy it at an agreed price, or upgrade to a new model. Think of leasing as a subscription for business assets.

Short version: buy = ownership; lease = subscription.

Why buy vs lease debate matters more in Kenya right now

When looking at lease vs buy, there are a few fundamental facts to note. Costs move fast. Import duties, foreign-exchange swings, and fluctuating fuel prices mean buying an asset today could look very different in value two years from now. More importantly, tying up a lump sum in equipment can leave you short when a supplier calls or a new opportunity knocks.

We’ve seen talented entrepreneurs lose momentum because their capital was parked in assets that weren’t helping them win the next job. On the flip side, we’ve also seen owners who leased when they should have bought and ended up paying more in the long run. The point? this decision affects cashflow, growth, and flexibility — so it deserves more than an instinctive “buy” or “lease” reaction.

Pros & cons — side by side (quick and practical)

Buy — the benefits

- Full control over the asset.

- Potential long-term cost savings if you use the asset for many years.

- Asset can be used as collateral for future financing.

- No contractual usage restrictions.

Buy — the downsides

- Large upfront capital requirement.

- Depreciation and maintenance costs.

- Risk of obsolescence (especially for IT and tech).

- Opportunity cost: money tied up could fuel sales, marketing, stock.

Lease — the benefits

- Conserves working capital — you keep cash for operations.

- Predictable monthly payments for easier budgeting.

- Easier access to newer models and upgrades.

- Often includes maintenance or service packages (ask for this).

- Faster scaling — you get the asset now, not after you save up.

Lease — the downsides

- Total cost can be higher over a long term.

- Limited modification rights on leased assets.

- Early termination can be expensive if not negotiated well.

- Some leases have strict repossession terms.

The money math (simple example you can actually use)

Let’s be practical. Suppose you need a delivery truck.

Buy

- Purchase price: KES 6,000,000

- Maintenance (5 years total): KES 2,000,000

- Residual value after 5 years: KES 1,500,000

Net cost over 5 years = (6,000,000 + 2,000,000) − 1,500,000 = KES 6,500,000

Annual cost ≈ KES 1,300,000

Lease

- Monthly lease: KES 130,000 → Annual = 130,000 × 12 = KES 1,560,000

- 5-year total = 1,560,000 × 5 = KES 7,800,000

Result: Over 5 years, leasing costs KES 7,800,000 vs buying net KES 6,500,000. Buying is cheaper in this example — but notice the key difference: leasing preserves KES 6,000,000 of upfront cash you can put into stock, fuel, or a new contract that earns profit. If leasing lets you win a KES 20M client that you couldn’t afford otherwise, leasing is the smarter move.

(Numbers above are illustrative. We’ll run figures for your exact case if you want.)

When you should probably buy

You should lean toward buying when:

- You plan to use the asset for a long time (think 8–10+ years).

- Maintenance costs are low and predictable.

- The asset holds resale value that offsets long-term cost.

- You have spare capital — and using it won’t choke operations.

- The asset is core to your competitive edge and needs heavy customisation.

Example: A bakery that owns a specialized oven used daily and expected to last 12+ years will likely save money by buying.

When you should probably lease

Choose leasing when:

- You need the asset now but lack upfront capital.

- The asset may become obsolete (IT equipment, medical devices).

- You want flexible scaling (seasonal or project-based needs).

- You prefer predictable monthly costs for budgeting.

- You want maintenance bundled to avoid surprise repair bills.

Example: A logistics startup that needs to quickly expand routes can lease trucks to grow fast without wiping out its cash.

Sector notes — quick hits for common Kenyan businesses

- Transport & Logistics: Lease to scale fast; buy for established long-haul fleets with stable routes.

- Construction: Lease big excavators for specific projects; buy if you have continuous pipeline.

- Agriculture: Lease seasonal machinery (planting/harvest); buy if you use year-round.

- Manufacturing: Buy for stable production lines; lease to pilot new product lines.

- IT & Clinics: Lease — technology and diagnostic equipment age fast.

Risks, negotiation tips & red flags

Watch for hidden fees, vague maintenance clauses, or punitive early-termination terms. Negotiate:

- Maintenance and insurance inclusions.

- Clear buyout price at lease end.

- Grace periods for delayed payments.

- Fair repossession terms.

Red flags: lenders who hide fees, refuse clear buyout terms, or insist on vague legal clauses. If a contract reads like a trap, walk away or ask us to review it.

Tax & accounting (high level — check with your accountant)

- Some lease payments are tax-deductible as operating expenses — this can lower your taxable profit.

- Finance leases may appear on the balance sheet; operating leases may not — check current accounting standards with your accountant.

- VAT and customs on imported leased equipment can behave differently — again, confirm with your tax advisor.

We’re not your tax accountant, but we work with partners who understand Kenyan tax treatment for leases. Ask us to connect you.

Decision checklist — answer these before you decide

- How long will you use the asset?

- Is the asset likely to become obsolete soon?

- Can you afford the upfront purchase without hurting operations?

- Do you want to preserve cash for growth?

- Who pays for maintenance and insurance?

- What is the expected residual/resale value?

- Are there tax advantages to either option?

- What are the early-termination penalties?

- Can you negotiate upgrade or buyout terms?

- Does leasing let you win business you’d otherwise miss?

If you’re unsure on any of these, let’s run the numbers with you.

Quick FAQ about Lease vs Buy

Q: Can small businesses lease used equipment?

A: Yes — used leases often cost less. Inspect condition and warranty terms.

Q: Will leasing affect my ability to borrow later?

A: Predictable lease payments often improve your credit profile, but read covenants carefully.

Q: Can maintenance be included?

A: Yes — many leases bundle maintenance for a predictable cost.

Q: What happens at lease end?

A: Options: return, buy at pre-agreed price, or upgrade.

Q: How fast can we get a lease approved?

A: With the right documents, we can move quickly — sometimes within days.

Why consider Discount Capital’s Leasing Finance?

We tailor leasing packages for Kenyan SMEs — flexible tenors, maintenance add-ons, transparent buyout terms, and quick approvals. We’ve helped businesses scale fleets, upgrade production lines, and access modern equipment without choking their cashflow.

If leasing keeps your business running, lets you win the next contract, or frees cash to invest where it matters — it’s worth a conversation.

Final word — no dogma, just options

There’s no moral high ground — owning isn’t always wiser, and leasing isn’t always lazy. The right choice depends on your cashflow, plans, and the sector you’re in. We’re here to help you make that choice with real numbers and zero jargon.

Want us to run a free Lease vs Buy assessment for your specific asset?

We’ll plug your numbers into a TCO calculator and show the clear path.

📞 Call/WhatsApp: +254 713 383855 / +254 711 093106

✉️ Email: info@discountcapital.co.ke

🌐 Learn more: www.discountcapital.co.ke

🏢 Visit: 7th Floor, International House, Nairobi

Let’s make sure your next asset helps you grow — not hold you back.